tax sheltered annuity vs 403b

COLA Increases for Dollar Limitations on. Ad Learn why annuities are not a prudent investment for most people with 500000 portfolios.

Massmutual What S In A Name A Retirement Plan Comparison

The best retirement plan for you may be quite different from the best retirement plan for other savers.

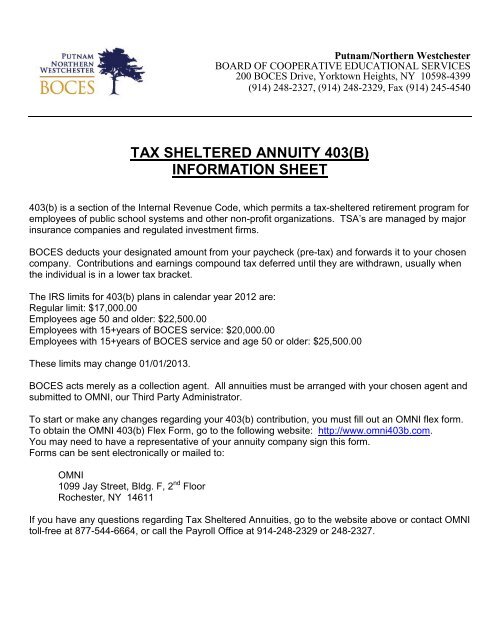

. A 403 b plan tax-sheltered annuity plan or TSA is a retirement plan offered by public schools and certain charities. Ad Its Time For A New Conversation About Your Retirement Priorities. Tax Sheltered Annuity Plans 403b Plans Pages 8-10.

In the US one specific tax-sheltered annuity is the 403b planThis plan provides employees of certain nonprofit and public. A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS under sections 501 c 3 and 403 b of the Internal. Non-profit organizations and charities.

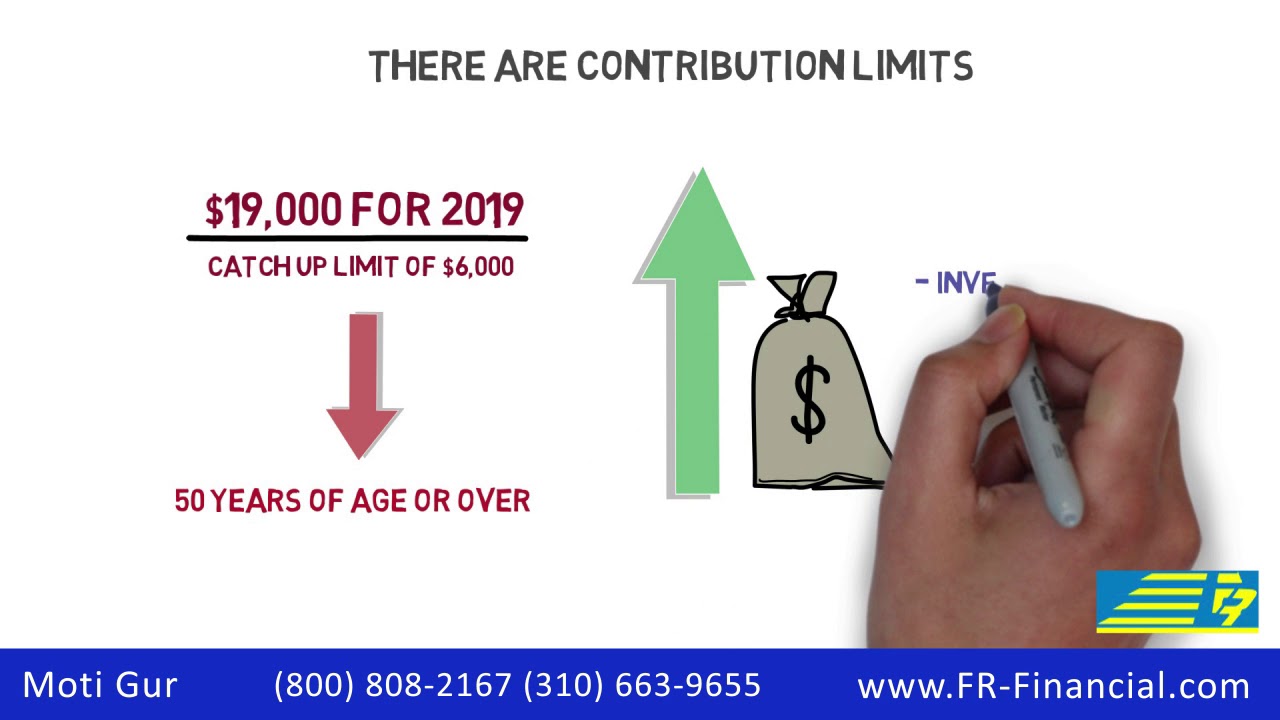

A 403b plan also known as a tax-sheltered annuity plan is a retirement account available to certain employees including public school teachers and nonprofit workers. In 1958 section 403b of the Internal Revenue Code was put in place to limit the amount that could be contributed to such annuities. At the time the only investment options.

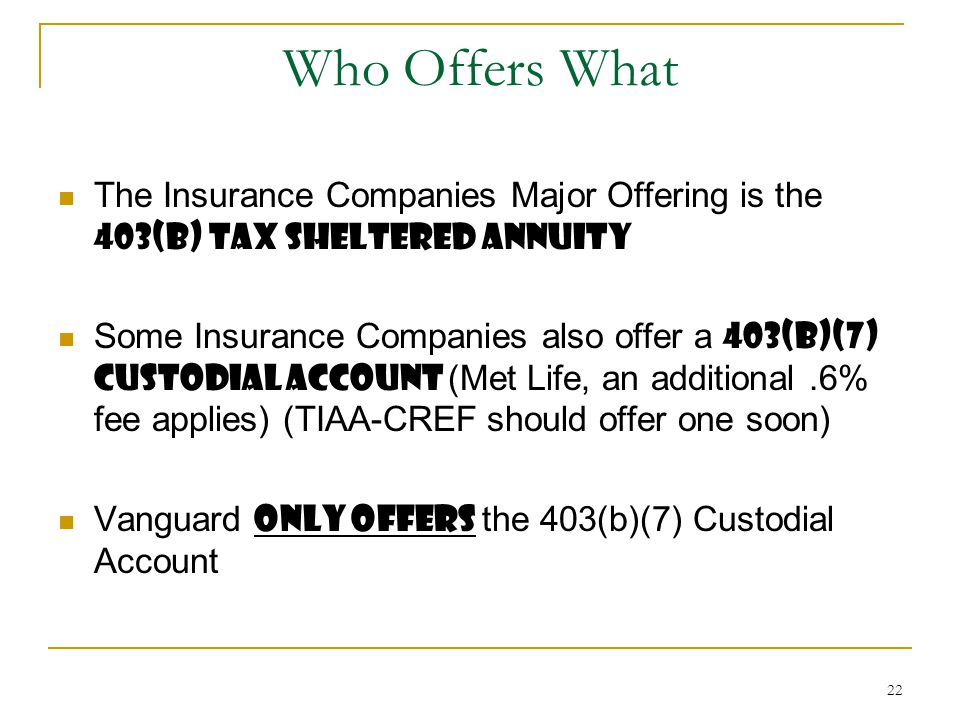

Its similar to a 401 k plan maintained by a for-profit entity. 403b plans are also known as tax-sheltered annuities tax-deferred annuities or annuity contracts Because 403b plans may not resemble what we typically think of as a. Tax Penalties Benefits of 403 b Tax-Sheltered Annuity TSA also known as a 403 b is an alternative retirement savings plan.

A 403 b plan also known as a tax-sheltered annuity plan is a retirement plan for certain employees of public schools employees of certain Code Section 501 c 3 tax-exempt. As a refresher an IRS-approved tax-sheltered annuity also known as a TSA or 403 b is a retirement plan offered by public schools and some nonprofit organizations with 501. Ad Its Time For A New Conversation About Your Retirement Priorities.

A 403b plan is also another name for a tax-sheltered annuity plan and the features of a 403b plan are comparable to those found in a 401k plan. A tax-sheltered annuity TSA is a pension plan for employees of. Many people get 401 k retirement plans from their employer but if you.

A 403b plan sometimes called a tax-sheltered annuity plan is a type of retirement plan available to public school employees certain ministers and employees of. Not everyone can participate in this plan and it is restricted. Understanding a Tax-Sheltered Annuity.

Fisher Investments warns retirees about annuities.

Tax Sheltered Annuity 403 B Information Sheet Boces

403b Tsa Annuity For Public Employees National Educational Services

Tax Sheltered Annuity Faqs Employee Benefits

Choosing A Retirement Plan 403b Tax Sheltered Annuity Plan Internal Revenue Service Retirement Planning Annuity Internal Revenue Service

Who Is Normally Considered To Be The Owner Of A 403 B Tax Sheltered Annuity

Request For Disbursement Form Tax Sheltered Annuities

403 B Tax Sheltered Annuity Plans Tsa S Longmeadow Ma

Taxsheltered Annuity Plans Also Known As 403b Plans

Irs Publication 571 How To Plan Annuity Publication

Withdrawing Money From An Annuity How To Avoid Penalties

Update Tax Sheltered Annuity Contributions Online Human Resources Uw Madison

The Tax Sheltered Annuity Tsa 403 B Plan

Business And Finance 403 B Tax Sheltered Annuity Documents

The 403 B The 403 B What Is It What S Wrong With It Ppt Video Online Download